One inevitable license should be applied for your trading company in China is the China Import Export License.

The most common investing vehicle foreign investors in trading industry adopts in China is the Trading WFOE (Wholly Foreign Owned Enterprise).

Import export license refers to the qualification of import and export enterprises to carry out the import and export business. The application for import and export right needs to pass a complicated examination and approval process.

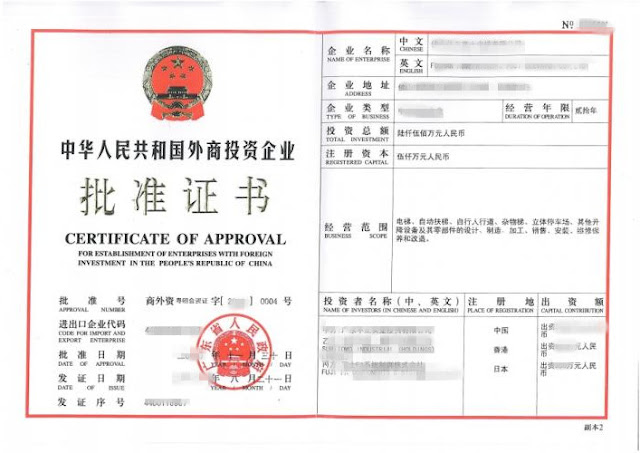

Certificate of Approval

When a foreign-invested enterprise is established, it shall be examined and approved by the business department. The Certificate of Approval is the first license should be issued as part of the Import Export License.

Customs Declaration Unit Registration Certificate

Trading WFOE must apply for the qualification of customs clearance. Registering with the customs is the precondition for the customs declaration.

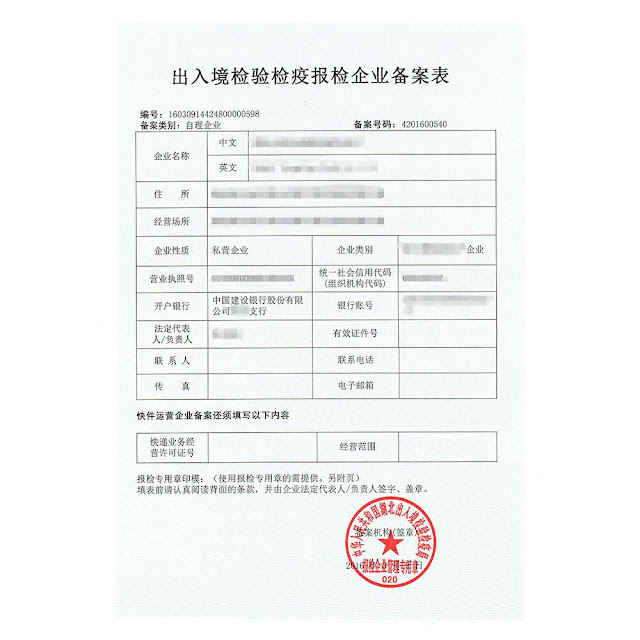

Entry and Exit Inspection and Quarantine Inspection Enterprise Record Form

To strengthen the supervision and management of the entry-exit inspection and quarantine inspection enterprises, trading WFOE must apply for the Entry and Exit Inspection and Quarantine Inspection Enterprise registration.

Electronic Port Card Reader / IC Card

China electronic port is a public data center and data exchange platform. It uses modern information technology and the national telecommunication network to centralize the data collection of customs, foreign trade, foreign exchange, taxation, industrial and commercial, quality inspection and transportation, etc.

Foreign Exchange Settlement Account

Chinese trading WFOE can apply to open a foreign exchange settlement account with the designated foreign exchange bank and reserve a certain amount of foreign exchange to benefit international trade settlement.

The most common investing vehicle foreign investors in trading industry adopts in China is the Trading WFOE (Wholly Foreign Owned Enterprise).

Import export license refers to the qualification of import and export enterprises to carry out the import and export business. The application for import and export right needs to pass a complicated examination and approval process.

Certificate of Approval

When a foreign-invested enterprise is established, it shall be examined and approved by the business department. The Certificate of Approval is the first license should be issued as part of the Import Export License.

Trading WFOE must apply for the qualification of customs clearance. Registering with the customs is the precondition for the customs declaration.

Entry and Exit Inspection and Quarantine Inspection Enterprise Record Form

To strengthen the supervision and management of the entry-exit inspection and quarantine inspection enterprises, trading WFOE must apply for the Entry and Exit Inspection and Quarantine Inspection Enterprise registration.

Electronic Port Card Reader / IC Card

China electronic port is a public data center and data exchange platform. It uses modern information technology and the national telecommunication network to centralize the data collection of customs, foreign trade, foreign exchange, taxation, industrial and commercial, quality inspection and transportation, etc.

Foreign Exchange Settlement Account

Chinese trading WFOE can apply to open a foreign exchange settlement account with the designated foreign exchange bank and reserve a certain amount of foreign exchange to benefit international trade settlement.

Comments

Post a Comment